“Financial markets will find and exploit hidden flaws, particularly in untested new innovations–and do so at a time that will inflict the most damage to the most people.”

They say that hindsight is 20/20.

Well, in hindsight, I realize that yesterday would have been a great day to run a “Don’t Panic” livestream.

It’s one of those ideas I’ve had in my back pocket for when I start running more video-type content in the future. Just gotta get the course done first.

Anyway, the basic idea would be to run a livestream on big red days -- like yesterday -- to help calm the emotional storm that can happen. The reality of my trading system is that although the net liquidity in my account takes a hit, I get to collect some great premium.

Thus, red days are perfectly fine.

It does require a longer-term viewpoint and a certain amount of patience.

All requirements for professional trading anyway, in my opinion.

So...

I hope you didn’t panic yesterday.

It was a pretty normal pullback in the market and probably sucked in a lot of bears who are waiting for the “bubble to pop” and the “inevitable crash” to start.

My thoughts?

I don’t see that happening any time soon. Instead, I see the markets destroying the hopes & dreams of those bears and we make an irrational move higher. Forcing the bears to buy back shares for substantial losses that, in turn, force the market even higher.

But even if that doesn’t pan out, my system still collects premium.

I’ve designed it so I don’t have to be right in order to be profitable.

There’s a lot of freedom in that reality.

Today’s Macro Headlines (Source: Yahoo Finance)

Yahoo Finance

Why it matters …

From the article …

“US stocks recovered premarket losses on Wednesday as a tech-focused sell-off eased and the ADP payrolls report showed a return to job growth in the private sector last month. Investors were also eyeing a pivotal day for President Trump's tariffs and the federal shutdown.”

Looking under the hood of the article we find something interesting. Because the government is shut down, the undependable jobs report is late, so it cites the ADP private sector payrolls report.

According to Google Gemini: “ADP produces payroll for approximately 1 in 5 workers in the U.S. private sector and serves more than 1 in 6 U.S. workers in total. This is equivalent to about 26 million workers across more than 500,000 employers. ”

This is a much better sample set than the government’s data which consists of snail mail surveys. I personally believe we could get rid of the government system and take the top 3 payroll companies for a better read on jobs. Just a thought.

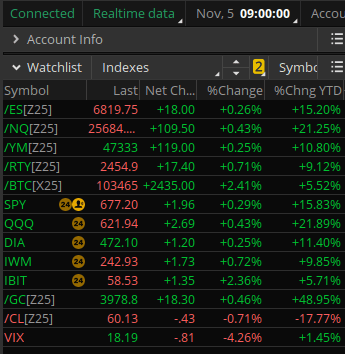

Index Snapshot

See the Legend in the footer below

Comments: Yesterday was crimson … Today looks more greenish but not as deep green as yesterday was crimson. I hope you were able to roll some positions for an additional premium. I know I rolled a lot of positions to next week or beyond while trying to keep a frown on my face so no one would know that red days generate some nice premium.

Stock Spotlight (Premium subscribers only)

I’ve got a crypto idea going for 1.45% return on risk into next Friday’s expiration.

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...