Today’s probably the final day of my video experiment (I haven’t decided if I want to record one for tomorrow). Please help me out by watching the short video and voting (if you didn’t yesterday) on this 1-question poll below:

“Whenever you find the key to the market, they change the locks.”

Just when I was starting to get scarily comfortable with the seasonal predictions of the Stock Trader’s Almanac, yesterday happened.

For those of you not on the Premium list, you probably missed that yesterday was predicted to be a bullish day. It’s based on some complicated math around seasonality in the markets. Anyway, Saturday we talked about the prediction for this week.

Well, yesterday was decidedly not bullish.

The blame game always happens when the markets make big-ish moves like that.

For instance, yesterday’s move is being blamed on some banking stuff.

I hold all of those headlines pretty loosely because the market does what the market does. I’ve experienced that looking for “why” rarely gives me an actual edge to making money.

The edge I do get is from having a solid trading plan.

My plan is to stack probabilities in my favor, have adjustments I can make when the trade goes against me, and be patient to let the bulls take charge — eventually.

Over time, the markets have always recovered.

So, I trade in a way that takes advantage of that fact.

It’s an almost absurdly-stupid-simple system that feels like printing money.

And making money is very fun.

Today’s Macro Headlines (Source: Yahoo Finance)

Yahoo Finance

Why it matters …

From the article …

“US stocks came back from significant losses Friday as President Trump eased worries of further trade escalation with China, while regional bank stocks also recovered amid investor jitters over bad loans and US credit quality.”

So the market was due for a correction and writers need to write. This is a case of the two colliding yet again but the resulting reporting not lining up with much reality. Yesterday was a bit brutal, but corrections are necessary for buying opportunities. Actually, I have only had to roll a couple of positions, and got great premium on those. Most of my positions should close out worthless today in spite of the reported news.

The reported catalyst for the pullback was news that smaller banks are making some risky loans. I’m not really sure that qualifies as news. It would help to explain why the larger banks have recorded some great earnings this week, but their share prices have fallen in spite of their earnings. Again, a market correction was due, so we are getting one. The Fear and Greed index that we discuss on the weekend edition has slipped into “Extreme Fear.” Look for Mr. Buffet to dust off his checkbook!

Plan the trades and trade the plan. It’s boring, but it works well.

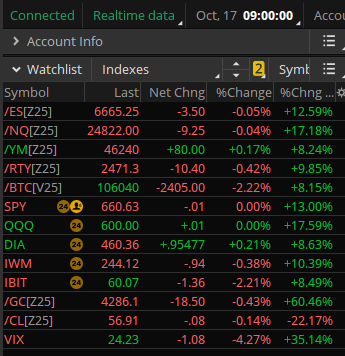

Index Snapshot

See the Legend in the footer below

Comments: So, it is a flat opening today. Bitcoin is down again, retesting the 200-day SMA. The government is still shut down, but the treasury actually reported a surplus due to the tariffs which means the military can get paid. (I think we should pay the military, before we pay Congress and their staff, but what do I know?)

Check your positions like a normal Friday and be prepared to make adjustments based on your preferences.

Stock Spotlight (Premium subscribers only)

An Alpha scan trade idea for around 1.76% return on risk into next Friday’s expiration.

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...