Special Weekend Edition

“An investor without investment objectives is like a traveler without a destination.”

A lot of people talk about setting SMART goals:

Specific, Measurable, Achievable, Relevant, Time-bound.

I want to focus on the measurable aspect, because it’s the big difference-maker I’ve seen between actually wishing for a goal and achieving a goal.

For example, this past year I started tracking my finances differently than I’d ever had before. I created a 1-slide “Vision Board” inside Google Slides. I set up three numbers to track. First, my total debt (between credit cards, car, home, student loans, etc.). I put that number in red and then in white brackets next to it, a quick gameplan on how to tackle it (e.g., 20% income / mo.)

Okay, that’s the debt.

But I also wanted to track building my wealth.

So I set up two more numbers: my total IRA and my total “Wealth” account (the Wealth account being a normal trading account, taxed at ordinary income rates).

Those numbers are in green, again with white bracketed words giving a quick gameplan (e.g., 7k max in IRA; 10%+ / mo. into my Wealth).

I know I just gave you a lot of specifics, but the tactic here doesn’t actually matter. It’s just an example. What matters is finding a system for you that helps you track your numbers and — this is important — see them all the time.

I turned my slide into my computer background.

Every time I hopped on my computer — which is multiple times per day — I saw that stupid red number that I want to go down to $0 and those awesome green numbers which I’m trying to get as high as possible.

As Peter Drucker said, “what gets measured, gets improved.”

All right, enough of that, let’s look at the markets.

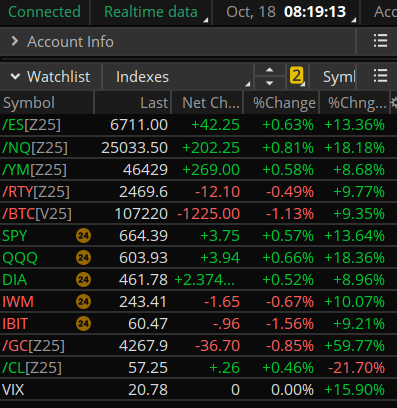

Index Snapshot

See the Legend in the footer below

So the week was like rafting down a Class 4 rapids, but turns out we are actually up from last week on all indexes except Bitcoin!

Fear and Greed Index

We dropped from 29 to 27 since last week. We actually dipped into “Extreme Fear” for a day or so. October is like that. Maybe that is why Halloween was set in October, ha!

Historically, November is a very good month. Hang in there, looks like some good buying opportunities. Actually, I am booking some really good premium during this “Fearful” time. I hope you are as well.

Today’s Macro Headlines (Source: Yahoo Finance)

Home inventory has climbed, but buyers are sidelined by high prices and mortgage rates above 6%.

Yahoo Finance

Why it matters …

This is not a surprise to anyone who thinks about it. When buyers know that rates are coming down in the future, they will hold off on purchasing homes if they can. Also, the home-selling season is in the spring, not the fall.

Sales will boom in the spring if the rates come down for about 6 months, then level off or tick up. People will swarm to buy houses if they think the rates are going back up.

Report on Friday’s Expired Real Trades & Sample Trade Ideas

Real Trade Spotlight (Free subscribers):

Three real trades collecting $137 of premium for single contract trades. Average Return on Risk (ROR) = 1.78% for this week.

Sample Trade Ideas Spotlight (Free subscribers):

Average Return on Risk (ROR) = 2.10%

Sample Premium = $232 for single contract trades.

...

Because it’s Saturday, Premium subscribers get the Special Weekend Edition, including:

Upcoming earnings to watch out for this week

A look at next week’s bullish/bearish tendencies

Spotlight on the Indexes

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...