“Wise men are instructed by reason, men of less understanding by experience, the most ignorant by necessity, the beasts by nature.”

Someone once asked me where I thought wisdom came from.

It was a totally out of left field question, so I had to think for a bit.

My conclusion was that we had two main sources: God and experience.

I’ll leave the supernatural source alone for now, though I do think it’s the better one to rely on. Instead, I want to dig into experience as a source of wisdom.

Here’s the cool thing:

It doesn’t have to be our own experience.

We can read, hear, see, learn from other’s experiences and thus gain wisdom when facing similar situations.

Perhaps this is what Cicero means when making this quote. That the wisest people among us are ones who learn from other’s experiences -- as well as their own -- and use logic to apply that learning to their own life. The people of less wisdom learn from their own experiences, maybe ignoring what others teach.

Of course, fools never learn.

Now, when I talk about fools, I’m talking about people who choose foolishness, not some unfortunate reality of their circumstances. I mean people whose actions are foolish and it leads them to bad outcomes.

You reap what you sow.

All that to say, if you want to gain wisdom, then my suggestion is to read the Bible (especially Proverbs) and to read and/or learn from others (books, courses, seminars, 1:1 coaching, etc).

Today’s Macro Headlines (Source: Yahoo Finance)

Wall Street is cheering weak jobs as a case for Fed cuts, but economists warn bad news won't stay good for long.

Yahoo Finance

Why it matters …

From the article…

“The bet is straightforward: Weaker jobs push the Fed to cut interest rates, lower rates lift valuations, and slower wage growth fattens margins.”

It is, indeed, a strange world we live in when bad news signals good news, and then signaling better news! More people are out of work, so the Fed should lower rates which would help people get more loans, but keep labor costs down for increased margins. Really strange world, but that’s where we are.

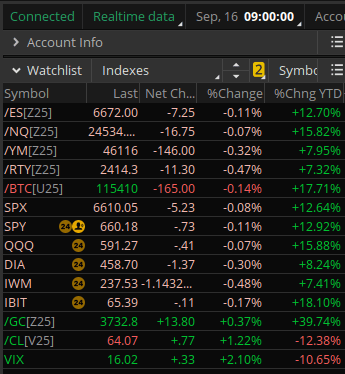

Index Snapshot

See the Legend in the footer below

Comments: The open is hovering around “unchanged” across the board. I know there’s a lot of red, but the percentage drop is low enough that this is basically sideways. The market is sitting on its hands in anticipation of tomorrow’s Fed announcement. It’s a really good day to go kayaking and listen to the sweet sound of premium decay (ha ha).

Stock Spotlight (Premium subscribers only)

I’ve got a trade idea this morning that’s still going for around 1.51% return on risk into this Friday’s expiration.

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...