“You get stepped on, passed over, knocked down, but you have to come back.”

A couple years ago I read a pretty remarkable book:

The ONE Thing by Gary Keller.

I find that it’s always good to learn from people who have already accomplished things you’re wanting to accomplish. Mr. Keller is a very successful businessman, and he put out a simple-yet-profound tome.

His main idea:

What is the ONE thing you can do so that everything else becomes easier or even unnecessary?

It’s a way to organize your projects and tasks so you can have the maximum impact with your highest energy efforts.

Unfortunately, I mostly ignored this lesson.

I fell into the trap of setting up longer to-do lists. I ended up doing some sort of 1-3-5 system where I had a highest priority item, three high priority items, and then five important-but-not-too-important items.

The reason that hasn’t worked for me is because it actually got me stuck doing lots of little (mostly) meaningless tasks -- where I would feel like I’m accomplishing something -- but never tackle the big tasks that actually move me significantly forward.

It wasn’t until watching some Alex Hormozi last week that I learned how vital it is to focus on that ONE thing ... and then scrap the rest!

Instead of having an eight item to-do list with an “A+” task, three “B” tasks, and five “C” tasks, I’m better off by having ONE “A+” task and nothing else. When I finish that task, then I can find a new “A+” task and do that.

I’m not saying you have to follow this advice, but it’s been working for me this week. So, I thought I’d share.

Today’s Macro Headlines (Source: Yahoo Finance)

The path to the next interest rate decision is littered with points of contention.

Why it matters …

From the article…

“New Federal Reserve governor Stephen Miran said Monday he wants central bank interest rates to be roughly 2 percentage points lower, arguing that the current level is too high, posing risks to the economy.”

So, there is now a single Fed board member who is pushing hard for larger rate cuts. He is outnumbered to be sure, but he could persuade the board toward a 0.5% cut instead of just lowering rates by 0.25% each month. This kind of pressure all but guarantees a rate cut, the question becomes, “how much?”

Any rate cut will help the market, especially the Russell 2000 small cap stocks as we have seen since this month’s rate cut. IWM and TNA are pretty good ETFs to sell Puts against, in my opinion (note: TNA is a leveraged ETF, so be careful with that one).

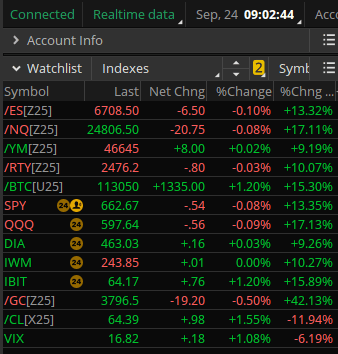

Index Snapshot

See the Legend in the footer below

Comments: The market is mixed this morning, but basically flat. Institutions should be re-investing capital in the next 3 days from last Friday’s expirations. Might be some fun days ahead, but the system works either way.

By the way, yesterday I did a marathon session of edits to my trading course ... all the edits are finished! So, the main course is basically done, although there are some bonus case studies & guides I need to create ASAP. I’m pushing for an early October release, but we’ll see.

Stock Spotlight (Premium subscribers only)

Here’s an idea from my Alpha scan going for 1.23% return on risk into next Friday’s expiration.

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...