“A man should always hold something in reserve, a surprise to spring when things get tight.”

Have you ever been 95% finished with a project only to get stuck at that last 5%?

Yeah, that’s about where I am with this course.

I know I’ve teased it a lot over the last few months (and I’ve been working on it — admittedly off and on — for longer than that) but I’m almost ready to release it.

I’ve sent it out to some Alpha viewers and have gotten some good feedback. Though, of course, this means more tweaks & changes before it’s ready.

In some ways it feels like a plane circling an airport.

I keep getting closer and closer to the landing zone, but I also need to circle around for another pass.

At some point it will be good enough for publication.

But not today.

You may have to dig a little deeper for trading lessons in there, but something you don’t have to dig for is today’s headline:

Today’s Macro Headlines (Source: Yahoo Finance)

The coming season brings two potential forces on stocks: tax loss harvesting and year-end catching up.

Yahoo Finance

Why it matters …

From the article …

“The happiest season is almost here. And that means the calendar will be exerting a quiet but important force on the stock market in two potentially meaningful ways: tax loss harvesting and year-end catching up.”

Expect the 2025 losers to lose more as investors sell losing positions to offset gains for tax purposes. This generally occurs more in December than October, but it still should be something to keep in mind when selecting stocks in which to sell Puts.

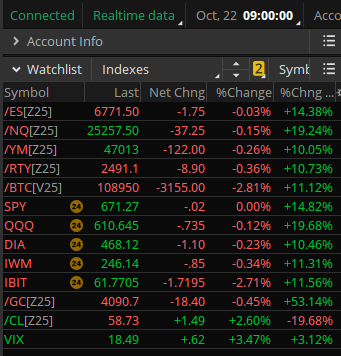

Index Snapshot

See the Legend in the footer below

Comments: The market is still catching its breath today as we open a little down today. The earnings reported are very positive so far, so expect that to start to push the markets higher at some point. The almanac indicates the next couple of days are historically bullish, so that might be an indication of when this could occur. The CPI is supposed to be released on Friday which will be a gauge of inflation going into next week’s FOMC meeting. British inflation was higher, but that may or may not be reflected in the US numbers.

Sample Stock Spotlight (Premium subscribers only)

Here’s an idea from my Alpha scan going for 1.35% return on risk into next Friday’s expiration.

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...