Special Weekend Edition

“Money is the opposite of the weather. Nobody talks about it, but everybody does something about it.”

It’s kind of strange, isn’t it, that we don’t like to talk about the big, important things.

Oh sure, we’ll jabber about the weather. sportsball, funny & benign stories, all day long.

But talking about money carries a stigma.

I’m not trying to shift culture here, I understand the social norms of polite society and how chatting about money can unintentionally put others to shame. I get all of that.

The problem in my life is that not talking about money led me to not think about money.

Particularly when I was struggling to keep it.

I’ve used this quote before, but Peter Drucker wasn’t whistlin’ dixie when he said that, “what gets measured, gets improved.” I might add that what we think & talk about is what we’re likely to measure.

If I ignore money in my life, how can I hope to improve it?

For this reason I keep track of my money. I watch it carefully and do my best to improve my trading habits so I can grow my wealth.

And, yes, I’ll talk about money with people.

It’s a commonality we all share and I’m paying attention to it in my life and I’ve got a trading system in place that brings in around 2% premium per week that helps grow my wealth.

All of this is in an effort to improve.

Perhaps that makes me a strange, social pariah.

If that’s the price for financial freedom, I’ll pay it.

Index Snapshot

See the Legend in the footer below

Well, it was a roller coaster ride, but we finished up for the week across the indexes with a strong green day on Friday. There is some relief to be out of October and into November based upon historical averages. The Fed does NOT meet in November, generally the weather is decent, folks are in a good mood and we aren’t dealing with the stress of Christmas followed by the year-end.

Should be a good trading month, but the system works either way.

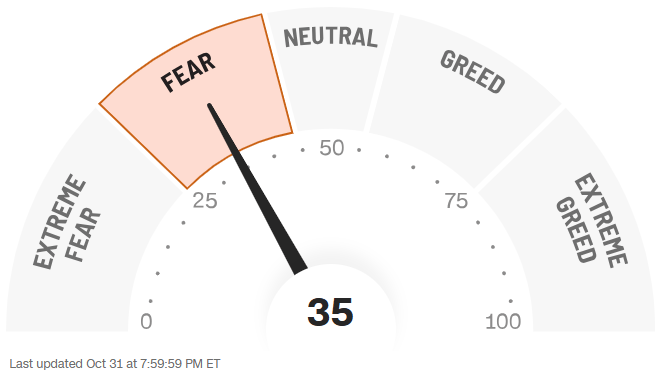

Fear and Greed Index

We have lifted from 33 to 35 since last week. This continues the oddity of achieving new highs with a “Fearful” index. We did not book a record premium last week, but we were able to finally close out some positions and have a lot of “dry powder” for Monday morning.

Today’s Macro Headlines (Source: Yahoo Finance)

In a week that included a Fed meeting and Big Tech earnings, the chip giant had a dizzying round of headlines.

Yahoo Finance

Why it matters …

There is a lot of talk about the AI bubble (mainly from bears with short positions). I just don’t see it. During the “.com” bubble valuations were insane on companies that had not made any money. The AI companies are not in that same situation. The valuations are not “nuts” (though some may be a bit high). Also, this is not “vaporware.” Most of these companies are producing hardware which is tangible. Some of the small nuclear companies are not profitable, but the technology is sound and available. Certainly there will be pullbacks as with any market, but AI is going to be here for a while.

The bigger question is what younger people need to consider decent long-term careers as AI will take a lot of the menial/clerical and even a lot of white-collar jobs. AI will never unclog your pipes or wire your house … just a thought.

Report on Friday’s Expired Real Trades & Sample Trade Ideas

Real Trade Spotlight (Free subscribers):

For the first time in this newsletter, I didn’t have capital to spare this week to put on some real trades. However, I booked a lot of trades yesterday and have quite a bit of powder ready for Monday.

Sample Trade Ideas Spotlight (Free subscribers):

Average Return on Risk (ROR) = 1.46%

Sample Premium = $280 for single contract trades.

…

Because it’s Saturday, Premium subscribers get the Special Weekend Edition, including:

Upcoming earnings to watch out for this week

A look at next week’s bullish/bearish tendencies

Spotlight on the Indexes

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...