“Q. What kind of grad students do you take? A. I never take a straight-A student. A real scientist tends to be critical, and somewhere along the line, they had to rebel against their teachers.”

A lot of trading wisdom -- I think it’s from Warren Buffett, but I could be wrong -- comes from the idea of buying when everyone else is panicking (i.e., selling), and selling when most people are jumping in to buy.

In other words, rebel.

In fact, for my own trading strategy, I’m looking for stocks that have had a bit of a recent downswing and look like they might be ready to turn back higher.

I’ve been burned many, many times by momentum trades (buying when a stock is moving higher and hoping it keeps that momentum going).

Sometimes they work, but a lot of times I found myself buying the top and selling the bottom.

That’s the kind of trading that blows up accounts and it’s what my system avoids doing.

I like my current plan:

Find a stock I think is at a bargain, sell Puts, wait for those Puts to expire worthless, repeat.

Simple. Profitable.

Yes, sometimes it doesn’t work out perfectly, and I have ways to deal with that.

Almost every business I know of makes its best money by buying low and selling high. I just do that in reverse order because Options are cool like that.

Anyway, on to the day’s headlines.

Today’s Macro Headlines (Source: Yahoo Finance)

Expectations for the meeting are low, as little clarity has emerged on whether key issues are up for negotiation.

Why it matters …

We are going to hear a lot about the shutdown this week. It is scheduled for midnight on Wednesday. Expect all the peacocks to have their plumes fully displayed. In the end, not much will happen either way. I suspect there will be a shutdown for a couple of days or even weeks, but, again, in the end not much will happen. Keep working the plan.

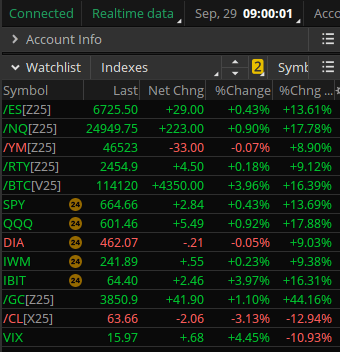

Index Snapshot

See the Legend in the footer below

Comments: We were decidedly green in the premarket this morning. The Dow has slipped since then. Even bitcoin seems to be getting a bid off the weekend. Oil is down a bit which might be helping to “greenify” the other indexes. Not the best on Monday for setting positions, so consider waiting until tomorrow which is historically a bear day or taking conservative positions.

...

I’ve got four trade ideas to share for the Premium subscribers averaging 1.64% return on risk.

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...