Special Weekend Edition

“Don’t worry about what the markets are going to do, worry about what you are going to do in response to the markets.”

Good news!

I’m in the later stages of Beta-testing my course.

If you’re not in the development world, this simply means that the raw course is finished and a select handful of people are watching it now to give me feedback.

So far, the feedback has been very positive.

I’ve got a few changes to make, but it’s mostly ready.

I’m thinking about doing a “Founder’s Price” launch for the month of November, knowing that the course will still need some adjustments but still letting you buy early access (as in, next week).

Is that something you want? Or do you want to wait for a finished 1.0 version?

Reply and let me know.

In the meantime, here’s some thoughts on last week’s markets:

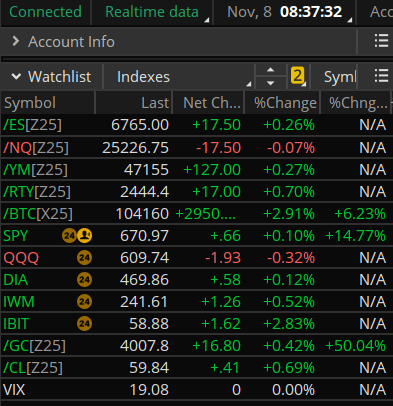

Index Snapshot

See the Legend in the footer below

We ended a little green, but it was a crimson week overall. Contrary to the history of the market described by the Almanac (which had a strongly bullish week predicted), the market pulled back quite a bit. Possibly, the Almanac folks didn’t project a record-breaking government shutdown! ha

Fear and Greed Index

We have dropped from 35 to 21 since last week. We were actually in the teens early yesterday. This is generally a good place to add positions on Monday if you have any dry powder. I don’t have much powder, but boy did I collect record premium this week!

Today’s Macro Headlines (Source: Yahoo Finance)

Yahoo Finance

Why it matters …

I think the best quote on this was heard late in the week from Senator John Kennedy (Republican) from Louisiana … “Lord, give me patience! Because if you give me strength, I’m also going to need some bail money!” I don’t care who you support, that’s a funny quote.

Report on Friday’s Expired Real Trades & Sample Trade Ideas

Real Trade Spotlight (Free subscribers):

Average Return on Risk (ROR) = 1.60%

Premium = $93 for single contract trades.

Sample Trade Ideas Spotlight (Free subscribers):

Average Return on Risk (ROR) = 1.61%

Sample Premium = $156 for single contract trades.

...

Because it’s Saturday, Premium subscribers get the Special Weekend Edition, including:

Upcoming earnings to watch out for this week

A look at next week’s bullish/bearish tendencies

Spotlight on the Indexes

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...