“Whenever you see a successful business, someone once made a courageous decision.”

I’d argue they made a LOT of courageous decisions.

I’m sure Mr. Drucker would have agreed with that.

One of the reasons I use a lot of thoughts & quotes around success in business is that I treat trading like a business. Because it is.

An easy mistake a lot of eager-beaver traders make is treating it like a hobby.

Hobbies are sort of designed to cost you money.

Think about it.

You spend money on a bunch of tools and teachings. Then you spend a lot of time working in the hobby, which to some can seem like a waste of time. But it doesn't have to be if the hobby helps refill your emotional tank so you can take on the world.

If hobbies cost you so much time & money ... and you treat trading like a hobby ... are you going to be successful?

That’s a reality I had to face.

Thus, I treat trading like a business. Putting in the hours, making informed risks, managing my risk.

It can almost get boring, except that making money is a lot of fun.

And the way I trade? Making money is pretty routine.

Just like a business should be.

Something to think about there.

Today’s Macro Headlines (Source: Yahoo Finance)

Yahoo Finance

Why it matters …

From the article …

“Weekly jobless claims just hit 263,000, the highest level in nearly four years. Preliminary estimates from the Bureau of Labor Statistics show almost a million fewer jobs were added in the 12 months through March 2025. And the slowdown is still underway: Payrolls grew by just 22,000 in August, averaging a meager 29,000 over the past three months.”

The Fed has a balancing act to perform for sure. Unemployment is ticking up and new jobs are not being created at a good rate. The CPI was up a bit, but the PPI was down a bit. The bottom line seems to be that inflation is in check, but we are losing jobs. That spells rate cut, but not a major one or inflation might go nuts. Again…a balancing act!

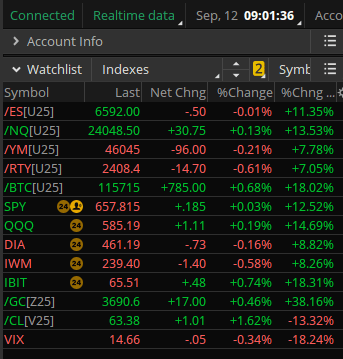

Index Snapshot

See the Legend in the footer below

Comments: Today has a mixed, muted sideways opening. Yesterday we hit all time highs, so the market may need to take a breath. Also, it is Friday which tends to see profit taking near the end of the session. If you have dry powder, you might hold it until later in the session to get some “bargains” for next week. (Please note, my crystal ball is still being repaired!)

Stock Spotlight (Premium subscribers only)

I really like today’s trade idea for around 1.81% return on risk into next Friday’s expiration.

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...