“There is no single market secret to discover, no single correct way to trade the markets. Those seeking the one true answer to the markets haven’t even gotten as far as asking the right question, let alone getting the right answer.”

Do you remember the old “Easy Button” commercials?

Staples, the office supply company, put out this series of ads where things looked hard until someone pressed the “Easy Button” and, like magic, the problem was solved.

Click ... “That was easy.” ... Done.

I think everyone is looking for an easy button to trade the markets.

We’d like to just throw our funds into an account, do nothing, and it just grows like clockwork.

Selling that dream was one reason Bernie Madoff -- the famous Ponzi schemer -- “made off” with so many people’s fortunes. He promised easy returns that worked like a clock.

As simple as my trading system is, it’s not automatic and it does require labor each week.

... about 2 hours of work each week.

Which, let’s be honest, if that amount of work is scaring you away from making 1.5%+ per week (on average) then I don’t know what to tell you.

Nothing worthwhile is truly “easy.”

But my trading system is close to “easy,” in my arrogant opinion.

😆

I hope that gives you a little levity today, because the main headline is a bit of a downer.

Today’s Macro Headlines (Source: Yahoo Finance)

Last month was the worst October for layoff announcements since 2003 as companies slashed roles to save money.

Yahoo Finance

Why it matters …

From the article…

“Employers announced 153,074 cuts last month, compared to 55,597 cuts in October 2024. Last month’s figure was “the highest total for October in over 20 years, and the highest total for a single month in the fourth quarter since 2008,” Andy Challenger, chief revenue officer for Challenger, Gray & Christmas, said in a report Thursday.”

This is government data subject to change, but the news is not good for jobs. AI and bloated companies from post-pandemic hiring are listed as the blames. Maybe, but probably this is just the normal result of keeping interest rates too high for companies to invest capital into their businesses. Couple that with the fact that folks are buying less because inflation has increased the price of groceries to a point that most folks are just treading water. The government shutdown is not helping anything.

Normally, this would be bad news for the market, but the poor jobs numbers all but insure another rate cut in December. The market likes lower interest rates as money flows from CD’s to stocks.

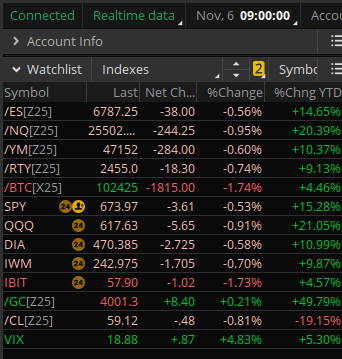

Index Snapshot

See the Legend in the footer below

Comments: Everything is dropping, except Gold and the VIX (volatility). Not a panic drop, just drifting lower. I had higher hopes for this week, but if it means more premium then bring it on!

Stock Spotlight (Premium subscribers only)

Here’s a uuuu-nique trade idea at about 1.54% return on risk into next Friday’s expiration.

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...