“Politics ought to be the part-time profession of every citizen who would protect the rights and privileges of free people and who would preserve what is good and fruitful in our national heritage.”

So, last week the Nasdaq posted the worst week since April (the tariff flush).

Yesterday it was up over 2 percent.

Today it’s settling back down.

That’s quite a whirlwind of changes in the markets. But here’s the cool thing:

Last week I had a record-breaking week in premium collection. Yes, my best week ever in my accounts came on a week when the markets “took it on the chin.”

It’s incredible to see.

And awesome to experience.

In other news: I’m finalizing some things today for the soft launch of my new trading course. If all goes well enough, I’ll open the doors tomorrow.

Please note that this will be a soft launch because I’ve taken the course about as far as I can with help from beta testers. It’s time to release version 1.0 so I can help you and your friends and make notes on what needs to go into version 2.0.

The perfectionist in me wants to wait until version 2.0 is perfect.

But the wisdom I have from others tells me that things are good enough right now and it’s time to take a “leap of faith.”

So, I’m spending today tying knots, crossing t’s and dotting i’s.

Keep your eyes peeled for the soft launch announcement soon.

Today’s Macro Headlines (Source: Yahoo Finance)

Yahoo Finance

Why it matters …

From the article …

“After a year dominated by artificial intelligence headlines, Wall Street’s bull case is shifting toward something more fundamental to stocks: earnings power that’s beginning to broaden beyond Big Tech.”

It looks like the market is starting to be swayed by the plethora of strong earnings from diverse sectors/companies. The catalyst of a shutdown ending could bring a very strong bullish push. We are also about to see a “boat” load of backlogged economic data hit which will give us some indication of what the Fed will do in December. My guess is that the jobs data will not be good, inflation will be holding steady and the Fed will have little option but to lower rates again in December. (Note: Crystal ball is still broken…)

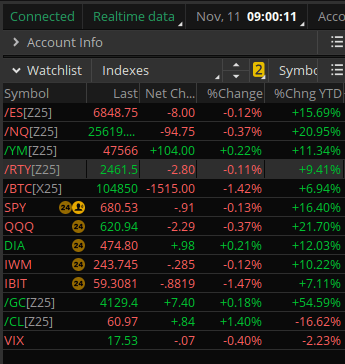

Index Snapshot

See the Legend in the footer below

Comments: Today looks like a good day to catch some breath after the Forest Green Monday. The Almanac shows a bearish icon historically for the day.

Stock Spotlight (Premium subscribers only)

My Bravo scan picked up a trade idea with a 1.15% return on risk into this Friday’s expiration.

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...