Reminder: Today is Friday, so if you have any expiring options contracts today, pay attention and make adjustments as necessary.

“The average man is always waiting for something to happen to him instead of setting to work to make things happen. For one person who dreams of making 50,000 pounds, a hundred people dream of being left 50,000 pounds.”

“Oh, bother!”

... as our honey-loving little Pooh bear would say.

What’s the matter?

Well, I’ve started and deleted about four different opening stories for today’s newsletter. I just kept writing stuff and then halfway through deciding that it just wasn’t going where I wanted it to go.

I know, that’s kind of weird. You’d think that since I’m the writer these words would be 100 percent controlled by me. But what actually ends up happening is I get started and the words flow and before I know it I’ve ended up somewhere strange.

... and then I look around and think, “how did this happen?”

You’ve probably experienced something similar when telling a story to someone and it sort of drifted into something else and before you knew it you were chatting about something completely out of left field.

Anyway, despite the very meta opening to today’s newsletter, I do have some thoughts to share about the markets.

Today’s Macro Headlines (Source: Yahoo Finance)

Yahoo Finance

The so-called clash had much more to do with the multi-billion dollar price tag on the new Fed buildings than it did with the interest rates. I suppose I shouldn’t be surprised, after all Trump has been building big buildings since the 80s. The man knows how big construction projects should work.

The softer tone here is that when talking about the possibility of firing Powell, Trump said: "To do that is a big move, and I just don’t think it’s necessary." Perhaps this leads to a rate cut sooner than September? I doubt it, but I would love to be wrong.

Yahoo Finance

President Trump’s modus operandi seems to be slash taxes and replace them with tariffs. The math is more complicated than that, of course. Because cutting taxes requires an act of Congress -- which we’ve already seen is tremendously difficult to do -- I suspect this is one of those “big asks” that Trump is floating to see how people react.

I couldn’t care less what class of income is most benefited from a drop in these taxes. I care more about how it affects the economy as a whole and therefore my own trades.

Yahoo Finance

A quote from the article:

“Investors may now be locking in profits ahead of a big week bringing the Fed's two-day policy meeting, the monthly US jobs report, and a flood of quarterly results highlighted by Apple (AAPL), Meta (META), Microsoft (MSFT), and Meta (META). Most of all, it features the Aug. 1 deadline for countries to strike trade deals with the US or face "reciprocal" tariff hikes.”

I think it would be wise to be cautious about the upcoming weeks. There will probably be good opportunities for new entries into new trades, if I remain patient.

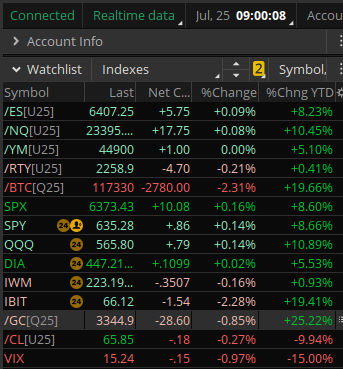

Index Snapshot

See the Legend in the footer below

Comments: Green, but no conviction. That remains the story of this bullish move. Notice that the SPY keeps inching closer and closer to my $648.98 topping target. We’re not that far away, and an injection of buying frenzy next week could do it. With all the big name earnings next week, we could see a big market move.

August 1st is still a big cave with a dragon inside. Will this thing shoot out fire and “burn” the markets? I don’t know, but I think it’s likely.

Stock Spotlight (Premium subscribers only)

I’ve got an idea for a quick, aggressive trade made in a conservative way. It’s 1.06% into next week and should cover a month’s subscription with just one contract...

UH-OH! I think you're missing the best part...

Only Premium subscribers get access to the rest of this post including today's exclusive Stock Spotlight Sample Trade idea. It's only $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including...:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...