“Accepting losses is the most important single investment device to insure safety of capital.”

One of the things I’m grateful that games teach us is the reality of accepting losses and then moving on.

We must learn this in sports, board games, video games, or, really, any sort of competition.

Losses are inevitable.

No person or team remains perfect forever.

That lesson carries over into business, success, and trading.

Something I like about my trading system (and the Wheel strategy it is based upon) is that losses are actually rare. Only about 2% of the time will I need to actually accept a loss. The rest of the time, my losses remain unrealized.

What do I do with these unrealized losses?

Give them more time to become realized profits.

Incidentally, this is one of the reasons I mostly reject the bandwagon / momentum trading (where traders jump on a stock that’s at an all time high, hoping it continues even higher). That type of trading doesn’t stack the probabilities in my favor — even if it is fun to watch when it’s working.

I’d rather have more conservative entries and patiently wait for easy, high probability moves.

A bit more boring, but a lot less stressful.

All right, on to the day’s headlines.

Today’s Macro Headlines (Source: Yahoo Finance)

Investors are turning their focus to corporate earnings, with tech megacaps set to kick off their reports.

Yahoo Finance

Why it matters …

We have 2 weeks of U.S./China saber rattling before the meeting of the respective Presidents on Halloween in South Korea. Probably the ups and downs of the market will be blamed on tweets and truths, but really, the market will simply be the market, so trade accordingly.

I do think the earnings will be mostly, possibly overwhelmingly, positive this earnings season which will greatly help the outlook of most stocks. This will be one of several warnings to try to avoid earnings if possible when selling Puts. Try to give yourself at least 2 weeks so you can roll if you have to, or simply wait until after the reports to invest. It can get a bit dicey, but money tends to flow from the impatient to the patient.

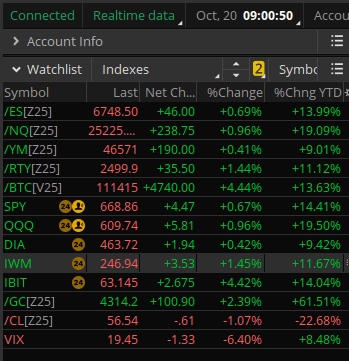

Index Snapshot

See the Legend in the footer below

Comments: All major indexes are up this morning. Nice start to the week. Almanac shows a bullish sentiment in the past … which may be your grain of salt for the day.

...

I’ve got 3 trade ideas to share for the Premium subscribers averaging 2.30% return on risk (yes, a bit higher than normal, but that leaves wiggle room for more conservative entries).

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...