“Do not blame anyone for your mistakes and failures.”

A few years ago I started making a shift in my life.

I had stumbled upon a former Navy SEAL named Jocko Willink who put out some hard-hitting discussions on his podcast.

His book, Extreme Ownership, talks about the importance of taking responsibility for all mistakes and failures. Yes, even if — especially if — they are not 100% your fault.

Why?

Because ultimately the only things we can control are ourselves and our actions.

There’s little to learn & improve from if I simply blame someone else for a failure that happened to me. Even when I’m seemingly innocent of the failure, I still found myself in a situation where that failure could affect me.

For example, my worst trading losses came from times when I ignored my trading plan because “this trade idea HAS to work!”

I remember one time breaking apart a vertical spread (I no longer even trade spreads) so I could turn a loser into a winner. But since it increased my risk by thousands of dollars, I was on the edge of my seat (literally sweating bullets) for each uptick or downtick in the market.

In the end, I was down so much money (even though the ETF had made a pretty minor move) that I bailed out of the trade.

Then the market turned around and my original idea ended up working out.

Except I had already booked my loss.

A brutal day.

And...

All my fault.

My fault for ignoring my trading plan. My fault for not accepting a tiny loss. My fault for making a risky trading decision. My fault for being so overleveraged that I couldn’t emotionally handle a normal intraday ebb & flow. My fault for losing 5-figures I should never have lost.

All. My. Fault.

But, I learned from this mistake.

I never made a risky “adjustment” like that again. In fact, I don’t even trade in that kind of style anyway, because I’ve got a strategy that doesn’t need my profits to overshadow my losses — it’s just profitable (98% of the time, eventually).

All that to say, I agree with Mr. Baruch.

Today’s Macro Headlines (Source: Yahoo Finance)

Friday's delayed CPI report showed inflation holding stubbornly firm at a 3% annual rate, however.

Yahoo Finance

Why it matters …

From the article …

“The latest data from the Bureau of Labor Statistics showed the Consumer Price Index (CPI) rose 3.0% year over year in September, up from 2.9% in August but slightly below economist expectations for a 3.1% increase. That marks the highest reading since May and remains above the 12-month average of 2.7%.”

This is good news overall. So the “sky is falling, inflation is going to go through the roof because of the tariff talk” should be over by now. (But is it really??) The markets seem to like the information.

Plan the trades and trade the plan. It’s boring, but it works well.

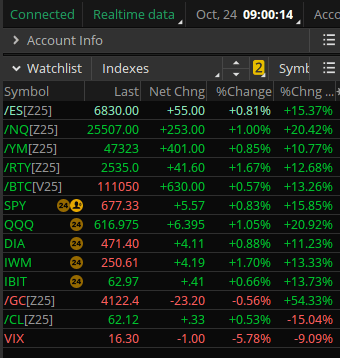

Index Snapshot

See the Legend in the footer below

Comments: Strong green opening for the indexes today credited to a “holding steady” inflation report. The labor market is still looking a little weak and I expect the Fed to favor helping labor increase over curbing steady inflation — meaning, I expect them to keep cutting rates (which is overall bullish for the markets).

Check your positions like a normal Friday and be prepared to make adjustments based on your preferences.See the Legend in the footer below

See the Legend in the footer below

Comments: Strong green opening for the indexes today credited to a “holding steady” inflation report. The labor market is still looking a little weak and I expect the Fed to favor helping labor increase over curbing steady inflation — meaning, I expect them to keep cutting rates (which is overall bullish for the markets).

Check your positions like a normal Friday and be prepared to make adjustments based on your preferences.

Stock Spotlight (Premium subscribers only)

A Bravo scan trade idea for around 1.29% return on risk into next Friday’s expiration.

WHOA! I think you're missing the best part...

Only Premium subscribers can read the rest of this post, including today's Stock Spotlight Sample Trade idea. Upgrade for just $21.87 per month.

Upgrade to PremiumPremium subscribers get access to exclusive content including:

- A look at real trades I've taken

- Sample trade ideas for you to consider

- Deeper dives on relevant stocks & ETFs

- Upcoming earnings to watch out for

- Next week's market predictions

- and more...